Comprehensive Global Payroll For Accountants

-

myPay Solutions

myPay Solutions is a full-service payroll & workforce management system designed for accountants to offer payroll solutions to their clients without the hassle and liability of preparing it themselves.

- Provides back-office payroll support that is responsible for the processing and tax compliance needs of your clients.

- Ensures all employees are paid on time and accurately, which helps protect and nurture your client relationships.

- Takes on payroll liability: Takes on tax liability and takes care of quarterly and annual returns.

-

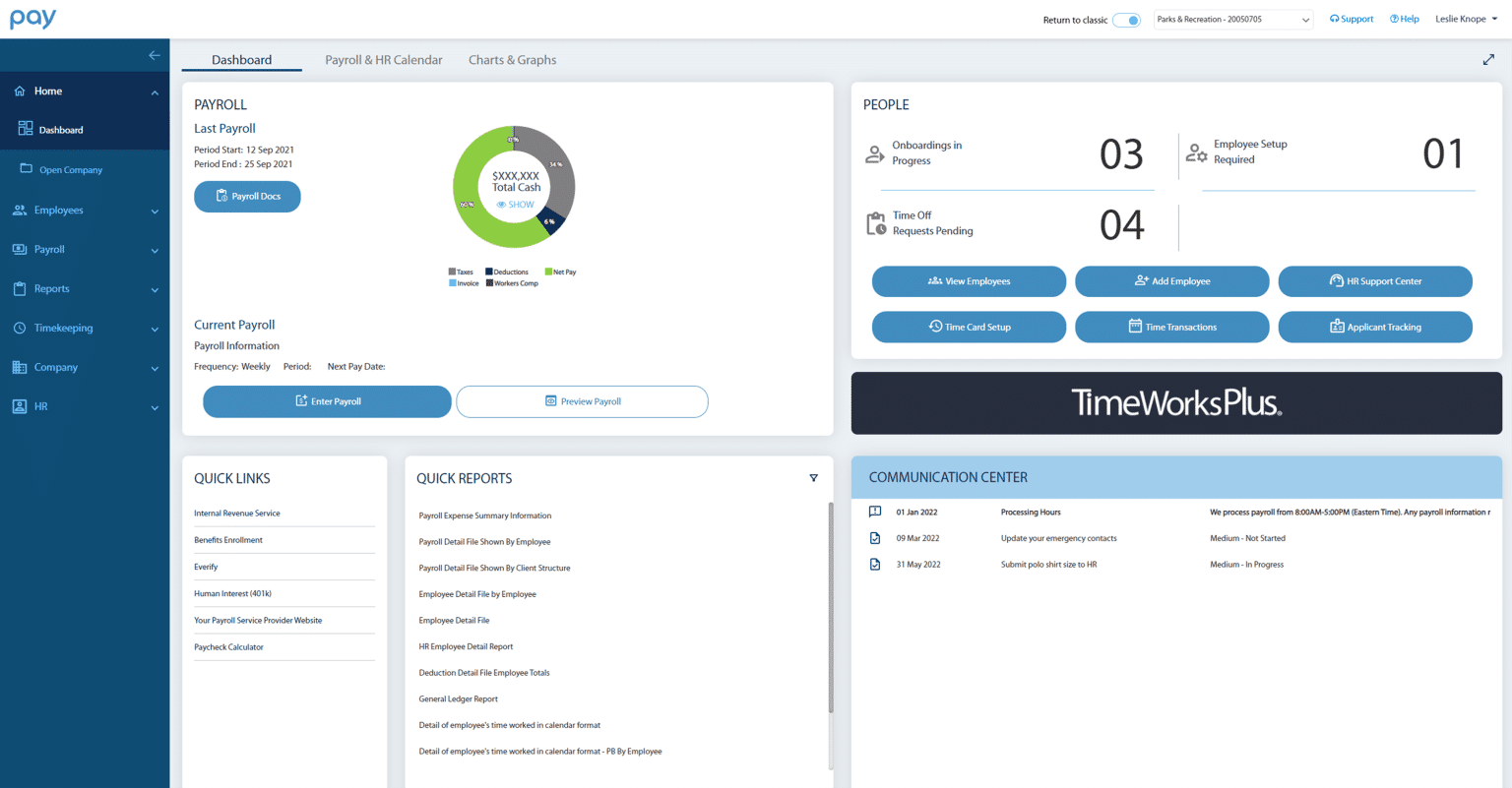

Apex HCM Payroll Software

Apex is an all-in-one, cloud-based, configurable HR and payroll management system with the power to handle complex payroll tasks with the flexibility of full control over all payroll and tax functions.

- Modern, easy to use interface with employer and employee mobile access.

- Includes HR tools to help your clients find, grow, and manage their employees.

- Simple and seamlessly integrated, our proprietary time and attendance solutions.

-

Payroll Relief Software

Payroll Relief is a payroll management system for firms that want to provide in-house accounting services for their clients but want a solution that does “heavy lifting” with fully automated payroll & compliance obligations.

- Automatic direct deposit, tax payment, filing of tax forms, and year-end processing.

- Streamlined payroll processing to manage a high-volume payroll practice.

- Employee Self Service (ESS) enables clients to onboard and train employees through an online portal while empowering employees to manage their data from anywhere.

“myPay Solutions feels more like a back-office partner than a separate service

bureau. They let me maintain my relationship with my clients, but they’re

always there when we need them.”

Christine Trumbull, Owner, CL Trumbull & Company, LLC

Why Choose IRIS Software?

-

A Payroll Solution for Every Business

One size does not fit all, we have a payroll solution to fit your specific goals and the needs of your clients.

-

Best-In-Class Technology and Support

IRIS solutions utilizes the latest technology and provides industry leading support needed to increase efficiency and revenue for Accounting Firms and Payroll Service Bureaus.

-

Comprehensive Global Coverage

IRIS Solutions provides payroll and HR support for clients with employees around the world, ensuring compliance with complex and varied laws and regulations in 135 countries.

-

Solutions to Grow Your Business

Our solutions help you do more with your time, provide services to increase your revenue and combat your competition.

Customer Success Stories

Our Awards